By: Jeremy Bilsky, Senior Director and General Manager at Advance Partners

While the U.S. rebound has had a bumpy start, the staffing industry continues to grow at an accelerated pace. According to a September 2021 Staffing Industry Analysts report, staffing revenue is estimated to grow by 16% this year, up from 12% growth estimated in the April forecast.

Clearly this is good news for staffing agencies. But, in a rush to recover lost revenue from the past 18 months, some firms may be tempted to make decisions that negatively impact their profitability. This could include lowering prices, accepting questionable contracts, or failing to negotiate favorable payment terms.

In this article, we discuss five ways staffing firms can sustain growth without sacrificing profitability.

1. Understand how staffing pricing works

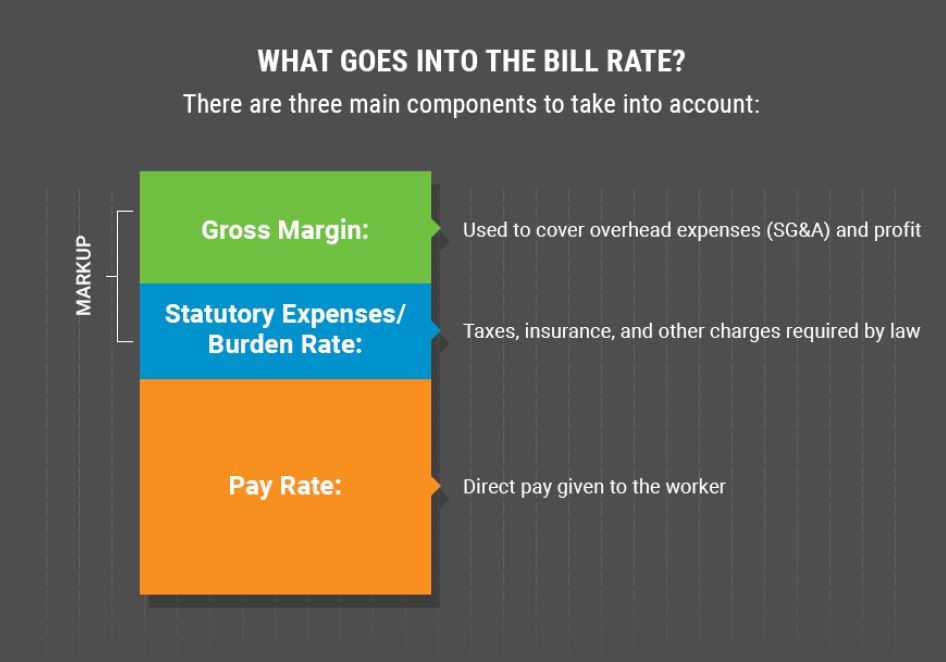

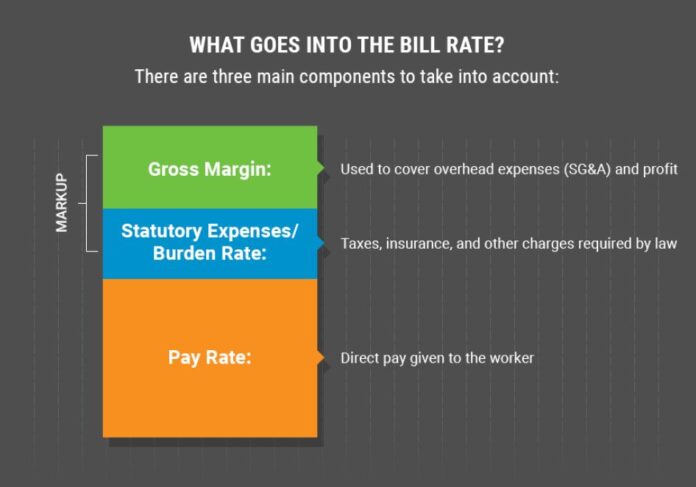

The first step to growing profitably in staffing is deeply understanding how pricing works in the industry. This can be especially tricky for newer firms that are balancing the challenges of running a start-up. There are three main components to consider when determining your bill rate: pay rate, burden rate, and gross margin.

Pay rate is what will go to your temporary worker. On top of that you will have your markup, which will be used to cover the cost of taxes and insurance (burden rate) and overhead expenses and profit (gross margin).

Essentially, you have to determine a fair rate that will help you compete for contracts but also leave you with a healthy profit margin.

2. Uncovering hidden costs in contracts

Another key step to profitability is understanding how contract terms can affect your bottom line. Careful review is key because “hidden” costs in contracts can add up and ultimately impact your bottom line in ways you might not expect. Here are a few hidden costs to look out for in staffing contracts:

- A large quantity of holidays or unpaid days

- Extra cost for background checks that is charged to your company

- Unreasonable additional insurance requirements such as very high general liability coverage

- Tight overtime restrictions

Bottom line, review your contract very carefully before agreeing to anything!

3. Controlling workers compensation claims

One of the biggest financial drains on staffing firms are WC claims. Controlling these claims is hugely important to profitability. Not everything is in your control, because ultimately worker safety depends on the customer. However, there are some steps you can take such as having WC insurance, engaging in general health and safety training, and having a systematic process in place for when a claim is filed.

4. Negotiating favorable payment terms

Staffing firms often wait 45, 60, 90 days for invoices to be paid while having to pay workers weekly. Favorable payment terms can help ease this burden. If a customer is unwilling to negotiate terms, you may want to consider implementing a late fee if they pay past their scheduled term.

5. Securing working capital for business growth

Many staffing firms turn to outside sources in order to keep the working capital flowing and stay profitable. You have a few options when it comes to this, the two most popular being bank financing and payroll funding. There are upsides and downsides to both methods, and some staffing firms use a combination to secure working capital.

Staying profitable in staffing is about more than just selling your services. Increased profitability involves ensuring that every level of your business is in line with your goals through careful planning, communication, and control. For additional information on how to stay profitable, check our whitepaper “Beyond Pricing: 10 Ways to Make Your Staffing Firm More Profitable” or try the free Staffing Profitability Calculator tool.

Jeremy Bilsky is the Senior Director and General Manager at Advance Partners. Jeremy has direct leadership responsibility for the Advance Partners business unit, leading the senior management team and all related functional areas. Jeremy has been with Advance Partners for over 15 years in many capacities, including General Counsel, Director of Portfolio Management, and serving on the executive team managing and overseeing Advance Partner’s internal risk functions.

Jeremy Bilsky is the Senior Director and General Manager at Advance Partners. Jeremy has direct leadership responsibility for the Advance Partners business unit, leading the senior management team and all related functional areas. Jeremy has been with Advance Partners for over 15 years in many capacities, including General Counsel, Director of Portfolio Management, and serving on the executive team managing and overseeing Advance Partner’s internal risk functions.