By David Folwell, Founder & President, Staffing Referrals

The strategic imperative of candidate lifetime value in modern staffing

When Starbucks calculated their customer lifetime value at $14,099 based on 2,820 visits, they discovered something profound: the real value wasn’t in the transaction, but in the relationship. This insight transformed how they thought about growth, investment, and competitive advantage.

The staffing industry faces a similar inflection point. While most firms focus on transactional metrics—cost per hire, time to fill—a vanguard of companies has discovered that candidate lifetime value (CLV) holds the key to sustainable differentiation and profitable growth in increasingly commoditized markets.

And there’s data to prove it. Firms optimizing for CLV through strategic referral programs are achieving up to a 213% improvement in profitability per placement compared to traditional job board sourcing. This isn’t incremental improvement—it’s fundamental business model innovation.

TL;DR:

Referral-powered talent networks lift CLV 213%, slash acquisition costs, and build an unbeatable moat—quantify CLV, launch a frictionless mobile referral flywheel, and sell community, not résumés.

Understanding the CLV framework in staffing

The traditional staffing model treats each placement as an isolated transaction. This approach systematically undervalues the true economic potential of successful placements. Consider the complete CLV equation:

CLV = (Gross Profit per Assignment × Number of Assignments) – Acquisition Cost

But this formula only captures direct value. The complete picture includes:

Extended CLV = Direct Value + Network Value + Strategic Value

Where:

- Direct value: Initial placement revenue plus redeployment opportunities

- Network value: Referrals generated

- Strategic value: Market intelligence, reduced sourcing costs, brand advocacy

When WSI shifted their sourcing mix toward referrals, they discovered referred candidates worked 4x more hours on average and were 2.7x more likely to be placed. The compound effect? They grew revenue 9% despite making 8% fewer placements—a masterclass in operational leverage.

The economics of differentiation: Why traditional models fail

The staffing industry suffers from what Michael Porter would call “stuck in the middle” syndrome—neither achieving cost leadership nor meaningful differentiation. Three structural challenges perpetuate this:

- Funding the competitor: Traditional sourcing funnels your money into job boards, building their networks so they can work with your customers. Essentially, you’re funding your own competition.

- Commoditized value chains: When 77% of placements start with the same job boards that your competitors use, differentiation becomes impossible. Clients increasingly view staffing as interchangeable commodity services, driving margin compression across the industry.

- Misaligned incentive structures: Traditional metrics incentivize speed and volume over value. Recruiters optimize for quick placements rather than long-term candidate success, creating a self-defeating cycle of high turnover and escalating acquisition costs.

Building your talent network moat: The Starbucks playbook

Howard Schultz didn’t compete on coffee quality or price. He created a “third place” where community created value. Progressive staffing firms are applying this insight by transforming their talent networks into proprietary assets that appreciate over time.

Strategic principle 1: Shift from inventory to ecosystem thinking

Traditional firms view candidates as perishable inventory. Network-centric firms cultivate talent ecosystems where relationships compound in value. Care Team Solutions exemplifies this approach—their “referral flywheel effect” created 12% growth while their market contracted 37%.

In ecosystems, value flows multidirectionally. A successfully placed nurse doesn’t just fill one position; she becomes a node in an expanding network that generates future placements, market intelligence, and competitive advantage.

Strategic principle 2: Optimize for CLV, not job board spend

Atlas MedStaff’s data reveals that referrals generate 46% higher CLV than major job board placements. The drivers:

- 90% lower acquisition costs

- 1.4x more assignments per candidate

This isn’t just cost reduction—it’s value creation. When Partners Personnel reduced advertising spend by 18%, they simultaneously improved fill rates and client satisfaction. They discovered what Peter Drucker meant: “Efficiency is doing things right; effectiveness is doing the right things.“

Strategic principle 3: Deliver a consumer-grade experience

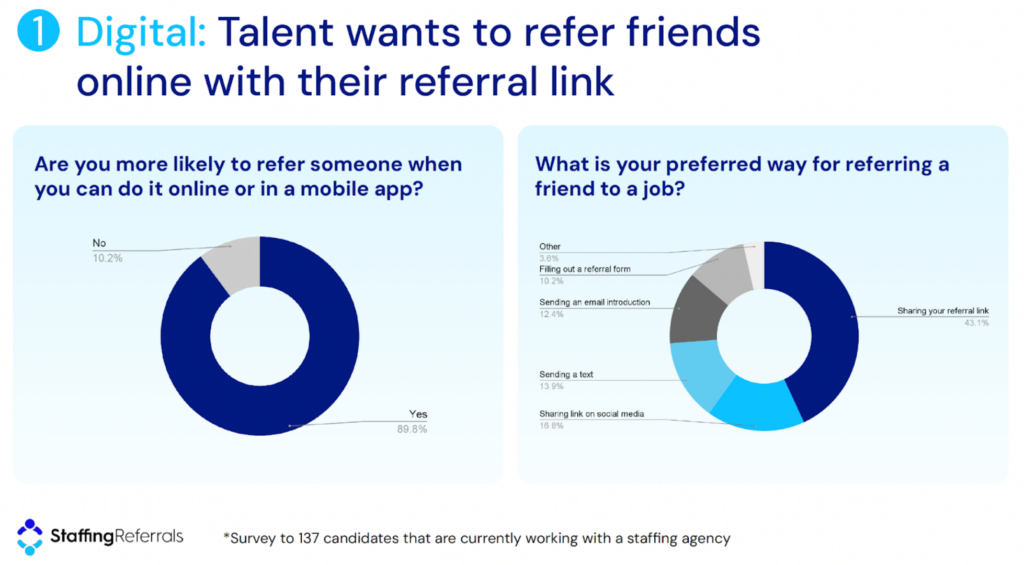

Today’s talent expects “one-tap” simplicity. If your referral flow feels clunky or dated, candidates bail—and they certainly won’t vouch for you.

Our survey shows nearly nine in 10 workers will refer only if they can do it on their phone and prefer sharing a personal link over any other method. Give them the same friction-free UX they get from their favorite apps, and watch your referral flywheel spin.

- 89% say they’re more likely to refer if they can do it on mobile.

- 43% choose “share my referral link” as their #1 method—more than 2× any other option.

Creating sustainable competitive advantage

Warren Buffett popularized the concept of economic moats—structural advantages that protect businesses from competition. In staffing, network effects create three distinct moat characteristics:

- Switching costs through social capital: Once candidates invest in building reputation within your ecosystem, switching becomes costly—not financially, but socially. This explains superior retention rates among referred candidates.

- Data network effects: Each interaction generates proprietary intelligence about candidate preferences, performance patterns, and network connections. This data advantage compounds over time, improving AI matching algorithms and predictive accuracy.

- Supply-demand aggregation: When CCS Construction faced an unexpected Indiana project, their network produced 70 qualified candidates in a geography where they had zero presence. This ability to rapidly aggregate supply and demand creates unprecedented market agility.

The strategic imperative: Measuring what matters

Traditional staffing metrics measure efficiency. Network-centric metrics measure effectiveness. Leaders should track:

Ecosystem health indicators:

- Network engagement (referrals per ambassador)

- Referral placement share (RPS = the percentage of placements that start with a referral)

- Active brand ambassadors (count of active referral network)

Value creation metrics:

- CLV by source (with full attribution modeling)

- Network reach (total number of brand ambassadors)

Implementation: From theory to transformation

Building a differentiated staffing firm requires systematic execution across five dimensions:

- Strategic repositioning: Stop selling labor supply (commodity) and start selling talent ecosystem access (differentiated asset). Your pitch changes from “we get you candidates fast” to “we have the community with the highest quality talent.” Speed is a given these days.

- Operational excellence: Ruthlessly eliminate friction in referral processes. If it takes more than 60 seconds to submit a referral on mobile or share a link, you’re leaving value on the table.

- Cultural evolution: Shift organizational mindset from transaction processing to community building. This requires retraining, new metrics, and aligned incentives.

- Technology integration: Choose platforms designed specifically for staffing workflows. Generic tools fail because they don’t understand the unique dynamics of contingent workforce management.

- Continuous innovation: Network advantages compound but aren’t permanent. Continuous investment in user experience and value creation mechanisms maintains competitive distance.

The road to profitable growth through differentiation

There are two paths to choose from—one leads to continued commoditization, margin compression, and eventual irrelevance, and the other leads to differentiated value creation, sustainable competitive advantage, and profitable growth.

The choice seems obvious, yet inertia is powerful. As Marshall Goldsmith observed, “What got you here won’t get you there.” The skills that built successful staffing firms in the job board era won’t create winners in the network economy.

Three actions for forward-thinking executives:

- Quantify your current CLV by source: You can’t optimize what you don’t measure. Calculate true lifetime value including network effects, not just placement revenue.

- Pilot network-centric initiatives: Start small but think big. Test referral automation with one team or market before scaling.

- Reframe your value proposition: Begin positioning your firm as a talent community, not a staffing vendor. This shift in narrative drives premium pricing and client loyalty.

The competitive advantage of community

When Starbucks calculated their customer lifetime value at $14,099, they weren’t just measuring coffee sales. They were quantifying the value of belonging, community, and repeated positive experiences.

The staffing firms thriving today have learned this lesson. They’ve discovered that in a world of infinite information and instant connections, the scarce resource isn’t candidates—it’s trusted relationships at scale.

The math is the motivator: referral-driven placements generate up to 213% higher CLV than job board hires. But the strategic implications run deeper. In an industry racing toward commoditization, talent networks represent a sustainable source of differentiation.

Smart staffing leaders are already turning their best placements into talent scouts, their satisfied clients into referral engines, and their databases into relationship networks. The rest are still posting jobs and hoping for the best.